Sales compensation is a balancing act between motivating reps and maximizing revenue. U.S. organizations spend more than $800 billion to manage their sales forces, with $200 billion devoted solely to compensation each year, according to Harvard Business School. Needless to say, sales incentives are a huge investment for companies.

Because of this, creating an effective sales incentive plan can be a difficult task. Many organizations struggle to identify which compensation method to use and whether or not a bonus structure or commission based pay is the best option for sales reps. To help, we’re breaking down the basics of bonuses vs. commission based pay structures, the pros and cons of each, and when to use each one.

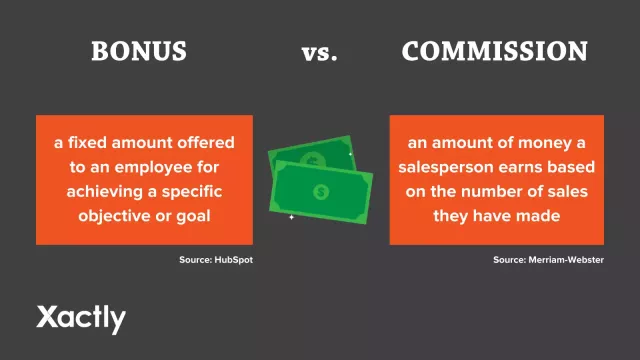

Understanding Bonus vs. Commission Plans

Sales compensation plans should be tailored to your company’s needs in order to reach your business goals. When it comes to a bonus vs. commission pay structure, both are popular forms of incentives.

Traditionally, salespeople earn commission based pay–an amount of money for meeting their quota. Bonuses are typically reserved for non-sales employees or used for sales reps in the form of a Sales Performance Incentive Fund (SPIF). Both can be extremely effective at motivating performance, but first, let’s break down the differences between the two.

Pay Structures

The biggest differences between a commission and bonus plan are the payment structure and how much sales reps earn.

Commission Based Pay

In commission plans, the total compensation amount will vary based on individual sales rep performance. Commission pay rates dictate how reps earn their compensation. Reps earn commission as a percentage (e.g., 6% of sales revenue) for every sale they make.

Once they’ve reached their sales quota, or sales goal, this rate often increases to encourage over-performance. Commission plans require strong sales commission structures to motivate reps to achieve and exceed quota.

Bonus Structures

Bonuses are stated sales incentive amounts. They may vary for individual sales reps and are represented by a percentage or fixed amount (e.g., 4% of base salary or a fixed amount of $7,000). It’s important to note that companies do not have to structure bonuses as “all-or-nothing” payments. If the quota is not met, sales reps can potentially earn a percentage of their bonus, which helps keep morale up.

What Determines Compensation

Sales compensation can depend on several factors in your incentive plan. In most incentive structures, a quota is the sales goal reps should aim for in order to earn their compensation, but it doesn’t necessarily determine how much a rep will earn.

Commissions

Quota guides sales reps towards their potential earnings, but ultimately, the amount they are compensated depends on each individual rep’s performance. Once reps hit quota, higher commission rate tiers sometimes kick in to motivate them to over-perform.

Bonuses

For a bonus structure, quota and sales rep performance will be major factors in earning compensation. However, unlike commissions, bonuses are typically a set amount and rely on both corporate and individual goals. This helps incentivize employees in all departments.

Bonus vs. Commission: Choosing the Best Pay Structure

The fact of the matter is different businesses need different compensation plans. Before putting together your incentive strategy, you should first ask yourself the following questions:

- What do we expect from sales teams in terms of performance (i.e., quota, revenue, etc.)?

- Will we be paying sales reps a base salary in addition to compensation?

- Will we be offering sales reps additional non-financial compensation?

- How can we motivate reps to achieve all of our goals within budget?

Knowing your goals and the answers to these questions, you can piece together your sales needs and ensure sales forecasting accuracy. This helps you then identify what your company can afford to pay reps (based on expected revenue) and craft incentives that will motivate reps.

When to use a Commission

Commissions, the most common type of compensation plan, can be offered with or without a base salary. However, most companies pair commissions with a base salary. They are more typical in businesses that are:

- Growing revenue teams

- Sales roles with more selling and prospecting responsibility

- Other customer-facing sales roles

Use a commission when you know the fixed amount of the money your business can reasonably afford to pay sales reps to sell your offering. Design your bonus plan to maximize compensation for well-performing reps and stay within your company’s budget.

When to use Bonus Pay

A bonus plan pays reps a bonus with a base salary. They are usually more appropriate for:

- Larger, more established revenue teams

- Sales roles with more administrative responsibilities

- Other non-selling roles

Implement a bonus plan when you have a more established business and want to focus on the idea of compensating sales reps at market value. Then build your plan to reflect the needs for each individual sales rep’s market value.

When to Consider Both

In certain situations, companies may benefit from a combination of commission and bonus compensation. This can be an obvious choice for companies that want to incentivize employees outside the sales team. In fact, regardless of the role, compensation motivates behavior. So bonus pay for non-sales employees may help inspire innovation and performance beyond closing sales deals.

Bonus vs. Commission: Final Thoughts

Both commission and bonus structures will allow you to compensate sales reps fairly and incentivize them to perform well in the future. Regardless of your compensation method, ensure that your plan boosts sales team productivity and moves you closer to achieving your business goals. Creating a compensation strategy with those goals in mind is the first step towards a successful business plan!

To discover how you can begin improving your compensation plan design and performance today, download our “2021 Guide to Successfully Managing Sales Compensation.”