The heart of sales performance is motivation. Without it, there is no incentive for your reps to push to close deals. When you get it right, it’s a win-win for you and your sellers. So it suffices to say, your sales incentive compensation plays a major role in your ability to drive revenue and growth.

And it’s a big investment. The average U.S. company spends more than $800 billion to manage their sales forces, with $200 billion devoted solely to compensation each year, according to Harvard Business School.

But not all compensation is the same. Depending on your goals, seller roles, and product and service offerings, you need to design sales commission structures that drive performance both effectively and efficiently. And as your business grows, it can be difficult to know where to begin and how best to scale.

To help you create revenue-driven compensation plans, here is everything you need to know about one of the most important parts—sales commission structures.

What is a Sales Commission Structure?

Traditionally, sales compensation is made up of two main parts: fixed and variable pay. Base salaries are designed to pay a fixed amount and are fairly straightforward. Sales commission structures are a component of sales variable pay, determine how reps will be paid, and indicate which behaviors salespeople will be rewarded for.

Using sales commissions as a part of your compensation plan allows for different configurations based on the given sales solution. Because of their variable nature, they can be a strong tool to motivate performance throughout your sales team.

But before you can send your sales team out to close deals, you first need to determine the best sales commission structures to use to motivate them most effectively.

Types of Sales Commission Structures

1. Revenue Commission Structure

One of the simplest and most commonly used sales commission structures is variable pay as a percentage of a single sale’s revenue. Under this incentive structure, reps earn a flat percentage for every sale. For example, imagine your company sells a product for $100,000 with a commission rate of five percent. For each unit they sell, your reps would earn $5,000 in commission.

When to Use a Revenue Commission Structure

Revenue commission plans work well for smaller sales teams and in organizations with less complex product/service offerings. They are also effective in situations where the focus is on a singular product or service with fixed pricing.

2. Gross Margin Commission Structure

Another simple sales commission structure is the gross margin plan. This commission model operates similarly to the revenue structure, but it also considers the profit of each transaction, including the price of the sale and the costs associated with it.

However, under a gross margin commission structure, a rep’s commission will be calculated on the gross revenue generated, rather than the total amount of the sale.

Here’s how that works with our example from earlier: Your business sells a product for $100,000, and let’s say that there are $10,000 of associated expenses with that sale. Your company would recognize a $90,000 profit on that deal. Based on the five percent commission rate, a rep would earn $4,500 (five percent of the $90,000 profit).

When to Use Gross Margin Commission Structures

This sales commission structure can help ensure bottom-line profitability while motivating reps. It works well as you begin to grow your sales team and scale your business.

3. Tiered Commission Structure

Tiered commission plans are designed to motivate sellers to continuously surpass certain levels of revenue sold. For example, imagine a rep earns five percent on each product sold up to $100,000 in total sales.

Under a tiered commission plan, that commission rate might increase to seven percent once the rep surpasses $100,000 in total sales. At $300,000, the commission rate may increase again to ten percent. This type of commission structure is highly effective because it encourages reps to over-perform as their rewards increase the more they sell.

When to Use a Tiered Commission Structure

Tiered commission plans are a great next step in scaling your sales team and business. Because they are designed to promote over-performance, they can be extremely effective compensation models for driving revenue in larger, more established sales teams.

4. Draw Against Commission

Another simple sales commission structure is a draw against commission, which acts as a "guarantee," paid with every sales paycheck. The draw is usually a predetermined amount that functions similarly to a loan or cash advance, which, depending on the incentive setup, reps may or may not be required to pay back.

For example, let’s say reps are guaranteed a $500 draw, and for the sake of simplicity, we’ll say this is a new rep just starting in their role. That first month on the job, they don’t sell anything, so they’ll receive a $500 draw on their paycheck. In month two, imagine they earn $2,000 in commission.

If the draw is recoverable, meaning it is required to be repaid, the rep’s commission payout would be adjusted to $1,500 to cover the draw from the previous month. Non-recoverable draws, on the other hand, operate more like a stipend. In that case, the rep would not repay the $500 and would be paid the full $2,000 commission.

When to Use a Draw Against Commission

This commission structure has two common use cases: 1) to help ramp up a newly hired rep, and 2) during times of uncertainty. Draws can provide ramping reps additional income until they are able to work at full capacity, and they also offer stability when there are outside factors impacting business, such as economic or market disruptions.

5. Multiplier Commission Structures

The multiplier commission plan allows companies to build custom-made compensation strategies, but it can be a tedious process to design and implement. The multiplier commission plan starts with a basic revenue commission structure, but then it's multiplied by a percentage factor of quota achievement. To simplify it even more, think of this plan as a combination of a revenue commission structure and a tiered commission structure.

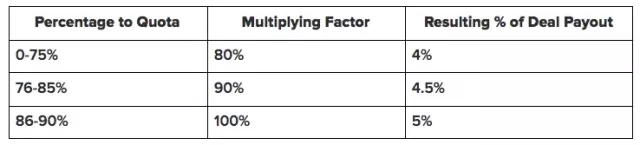

For example, say your sellers earn a flat five percent commission. With a multiplier structure, their pay will differ based on their percentage to quota.

Using the chart above, we can see that depending on a rep’s progress to quota, their commission rate will change. In this example, if a rep sells a unit for $100,000 and they are 80 percent to quota, they would earn a 4.5% commission, resulting in a $4,500 payment.

When to Use a Multiplier Commission Structure

Multiplier plans are beneficial when sales leaders want to use multiple performance measures in a rep’s incentive plan. They help drive specific sales behaviors to prioritize the most important deals for reps to go after. Using multipliers can not only help reflect the sales cycle but also help motivate sales reps to over-perform.

6. Straight Commission or Commission-Only Plans

Straight commission plans refer to paying reps on a commission-only model, with earnings made up entirely of variable pay (aka there is no fixed salary component). Some argue that the straight commission plans aren't necessarily a specific sales compensation structure. However, it's important to address what it means to be commission-only.

Under a commission-only plan, sales reps are extremely motivated to close their deals, but on the other hand, their work also comes with more stress given the amount of risk involved, which can increase the chances of sales burnout.

When to Use Commission-only Structures

Although it is not commonly used, there are certain situations where straight commission plans make the most sense, such as companies with shorter sales cycles, contract/temporary roles, or when there is an opportunity for sizable commissions, etc.

Determining the Best Sales Commission Structures for Your Team

There are several ways to build out your sales commission structures, and like many planning tactics, there is not a typical sales commission structure the industry considers to be the best solution. Consider the following questions when determining the best sales commission structures for your organization.

- What are our company’s goals and objectives?

- What is a realistic estimate of performance based on our sales resource capacity?

- How can we motivate each role successfully based on their different responsibilities?

- Are we driving the right behaviors with our incentives?

- Are our sales commission structures encouraging reps to perform beyond their quotas?

Answering these questions gives you the basis of information you need to develop your sales commission plans. With this information in hand, you can better determine which structure best suits your team and will drive the best performance.

When it comes to determining the right commission rates, again, there isn’t one perfect amount. Finding the right rate to pay reps determines on your industry, a salesperson’s role, geographic locations, and more. Here are a couple of best practices that can help you find the right number:

- Benchmark against industry data: One of the top reasons sales reps leave a job is for a higher-paying opportunity. HubSpot data shows that 40 percent would leave for a 10 percent increase in pay. A database like Xactly’s 15+ years of sales performance insights allows you to benchmark incentives within different industries, compare them against your own, and determine the most successful strategy for your team.

- Tailor incentives to sales roles: Different roles have different responsibilities. You can’t expect managers and their reporting reps to achieve the same results because their jobs are different. The work that a business development rep does is different from that of an enterprise account executive or sales engineer. Their sales commission structures should reflect that.

The Goal is Resilient Sales Compensation

Finding the right sales commission structure is essential to drive top-tier performance, but it is not the only factor in compensation success. You must continuously look for ways to motivate reps most effectively. As markets continue to shift, and change sweeps in seemingly overnight, it’s essential to adapt plans when the need arises. To do that, you need a way to answer the following questions in real-time:

- Do we have the best plan in place to achieve our goals?

- How can we build upon the success of past performance and incentives?

- Are there areas of weakness within our existing commission structures we can improve?

- Are we paying reps competitively compared to our industry competitors?

- If a top performer churns, do we still have the capacity to hit our goals?

Gaining this level of visibility requires a digital transformation. It’s not something that organizations can afford to wait on. Forrester research shows that the most successful companies are able to pivot plans in the face of disruption. Currently, only 27 percent are able to do that successfully.

Incentive Compensation Management tools like Xactly Incent help you turn your data into useful insights to make strategic decisions and ensure you’re always on the best path to reach your goals. It gives you and your leadership team confidence in your planning, deeper visibility into performance, and the ability to proactively adapt plans instead of scrambling to react when disruption hits.

To learn more ways you can adapt incentives to become more efficient and revenue-driven, download our guide “The Insights-Driven Revenue Leader.”